Federal employee pensions and benefits…and you were worried about your state

31 Mar

Does it ever end?

I and others have focused on the states for their generous benefits and underfunding of pension promises, but it appears there is a bigger issue facing taxpayers. Here is an article from the federal website for government employees. One big difference between federal and state workers is that federal employees pay significant premiums for their health benefits.

While there is a tendency for critics to jump on issues like this, here is a word of caution. The goal should not be to eliminate defined benefit pensions or retiree medical. The goal should be to design an affordable, sustainable total benefits package with fair cost sharing.

The private sector has been aggressive in eliminating defined benefit pensions, in eliminating retiree medical and in some cases trimming 401(k) benefits. While companies have cut costs, there are the long-term consequences. We are setting the stage for even more Americans unable to retire with the result they must stay on the job longer. We are creating a new generation more dependent on government programs. In addition, we are creating a new generation with a lower living standard and less discretionary income to spend on the goods and services offered by their former employers.

It appears Americans have already forgotten the experience of the last three years. The mashing of teeth over debt, poor investments and lack of saving is a distant memory. So now what do we do? Americans are not preparing for retirement, taxes are surely going up, Social Security and Medicare may be trimmed and tax breaks that help sustain current lifestyles are being questioned.

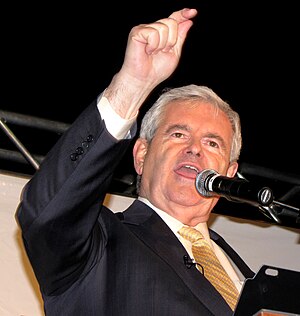

U.S. Senator Richard Burr (R-NC), along with Senator Tom Coburn (R-OK), introduced on Thursday the Public-Private Employee Retirement Act of 2011 (S. 644) to address long-term liabilities facing the federal government. The legislation would end the defined benefit pension portion of the Federal Employee Retirement System (FERS) for new federal government hires starting in 2013, leaving fully in place the Thrift Savings Plan with the current match (up to 5%) for both current and future federal workers. The bill would also apply to Members of Congress.

“Right now, federal government workers receive far more generous retirement benefits than private sector employees. The cost to taxpayers of these benefits is unsustainable and we simply cannot afford it,” said Burr. “We cannot ask taxpayers to continue to foot the bill for public employee benefits that are far more generous than their own.”

“The congressional pension plan currently in place only serves to foster political careerism and should have been frozen years ago. In addition to enjoying a better benefits package, federal workers generally earn up to 20 percent more than their private sector counterparts. When American families across the country are being asked to sacrifice in order to meet their basic needs, federal employees and members of Congress should not be the exception. Defined benefit pension plans are going belly-up across the nation because politicians and employers continue to make promises they cannot keep. Existing federal employees will be unaffected, and all federal employees would continue to enjoy a 401(k)-style pension plan with a very generous federal match. But the only responsible thing to do is stop making irresponsible commitments and forcing future generations to pick up the tab,” said Dr. Coburn.

Currently, federal workers enjoy both a defined benefit pension and a Thrift Savings Plan (equivalent to a 401(k)) with up to a 5% match, paid for by the taxpayers. The average private sector employee gets a 401(k) with a 3% employer match and no pension. Federal workers also continue to enjoy federal health care benefits (FEHB) after they retire, a benefit that is becoming increasingly rare in the private sector.

According to the Senators, the FERS system is currently underfunded by nearly a billion dollars. The old federal pension system, the Civil Service Retirement System (CSRS), is underfunded by $673 billion. In the coming years, as more of the retirement burden falls on the FERS system, the required federal government contributions to FERS will skyrocket, especially in comparison to what federal workers will put into the system. In 2012, the federal government will contribute $22.2 billion to FERS. By 2065, those required contributions will rise to $239.5 billion, with the government paying out $415.3 billion in benefits.

Current federal government employees and retirees would not be impacted by the changes in the Burr-Coburn bill.

This legislation is likely going nowhere, but the attention to pensions and employee benefits in the public sector is truly amazing to behold.

Recent Comments