Happy New Year

31 DecHHS sets “unreasonable” standard for health insurance premium increases and sets in motion the demise of insurance companies. It’s a bloody plot to undermine private insurance!

30 DecOkay, so I am being a tad dramatic here, but Rush Limbaugh would be proud. I want to get your attention so you read some facts about premium increases.

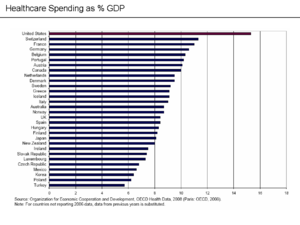

According to new HHS regulations, a health insurance premium increase of 10% or more should trigger a review at the state level, if not the federal level. In addition, there needs to be more transparence about these rate increases so the public knows what is going on. Keep in mind that during the health care reform debate the main target of the Administration was insurance companies, they were chastised and criticized for discrimination, abusive practices and outrageous premium increases. The debate boiled down to making the public see insurance as the culprit for all that is wrong with our health care system from intervening between the patient and doctor, to denying coverage to high cost.

What better way to keep this myth alive and to divert attention from growing health care costs (because health reform does little or nothing to actually control costs) than to put premium increases in the spot light.

Let us consider the facts. The average trend rate for healthcare costs is about 9% give or take a percentage. This means health care costs are increasing at nine percent per year. In addition, PPACA mandates, such as accepting individuals with pre-existing conditions, increase premiums from one and one half to two and a half percent on top of trend. These additional amounts do not include cost shifting resulting from additional fees, taxes, etc. on healthcare providers and vendors. This means that an eleven percent increase or more is largely out of the insurance company’s control. Thus, it is a foregone conclusion that the majority of rate increases will be at 10 or above percent simply based on escalating healthcare costs, elimination of underwriting rules and benefit mandates.

Given these facts, why was ten percent picked by HHS as the point at which “unreasonable” kicks in? Surely, the experts at HHS know what the health care trend is and that PPACA adds costs to health care. They also know that the public is largely focused on premiums as the cost of health care because most people are insulated from the true cost. In addition, they know that insurance companies are an easy target (much like the “wealthy”}.

The penalty for seeking unreasonable premium increase is exclusion from the health insurance exchanges starting in 2014, once again diverting attention away from the real issues surrounding our health care system and in the process perhaps limiting choices.

Let’s recap, what unfortunately are “normal” premium increases may be unreasonable, asking for an “unreasonable” premium increase may get you excluded from state health insurance exchanges, which may put you out of business. The irony is that with all insurers now playing under the same federal rules, their only edge is to complete on lower premiums if they want business from the other guy. HHS must think you are going to buy insurance from the most expensive insurance company. On the other hand, HHS may be trying to find a way to explain the fact that after health care reform will not control costs and that by 2014 premiums will have continued to escalate at substantial rates.

By golly, it is a bloody plot (just kidding…I hope).

Related Articles

Preventive services with no cost sharing begin January 2011, employers have decisions to make under PPACA regulations

29 DecBeginning January 1, 2011 new health plans and those health benefit plans that have lost grandfathering (generally as a result cost management plan changes) will provide coverage for many preventive services with no deductible, co-payments or coinsurance applied, in other words no cost sharing. The complete list of items and services that are required to be covered under interim final regulations can be found at HealthCare.gov

“In general, the recommended preventive services are: (1) Evidence-based items or services that have in effect a rating of A or B in the current recommendations of the United States Preventive Services Task Force (Task Force) with respect to the individual involved; (2) immunizations for routine use in children, adolescents, and adults that have in effect a recommendation from the Advisory Committee on Immunization Practices of the Centers for Disease Control and Prevention with respect to the individual involved; (3) with respect to infants, children, and adolescents, evidence-informed preventive care and screenings provided for in the comprehensive guidelines supported by the Health Resources and Services Administration (HRSA); and (4) with respect to women, evidence-informed preventive care and screening provided for in comprehensive guidelines supported by HRSA (not otherwise addressed by the recommendations of the Task Force).”

Regulations state that a plan is not required to provide coverage for recommended preventive services delivered by an out-of-network provider. Such a plan or issuer may also impose cost-sharing requirements for recommended preventive services delivered by an out-of-network provider. A plan sponsor must make a decision to cover or exclude preventive services from out-of-network providers and if covered whether to apply cost sharing. If these preventive services provide value, one could easily argue that it makes no sense to exclude them when provided out of network. Likewise, if one believes that cost sharing inhibits the use of such services, cost sharing should not apply even out of network. Rather, the plan sponsor may simply limit the payment for such out of network services to the payment allowed in network for the same service. That way the communication of coverage and cost sharing is the same, but the cost control remains with the plan and still provides an incentive to use in network providers.

Regulations state that a plan is not required to provide coverage for recommended preventive services delivered by an out-of-network provider. Such a plan or issuer may also impose cost-sharing requirements for recommended preventive services delivered by an out-of-network provider. A plan sponsor must make a decision to cover or exclude preventive services from out-of-network providers and if covered whether to apply cost sharing. If these preventive services provide value, one could easily argue that it makes no sense to exclude them when provided out of network. Likewise, if one believes that cost sharing inhibits the use of such services, cost sharing should not apply even out of network. Rather, the plan sponsor may simply limit the payment for such out of network services to the payment allowed in network for the same service. That way the communication of coverage and cost sharing is the same, but the cost control remains with the plan and still provides an incentive to use in network providers.

A second decision faced by a plan sponsor relates to certain services where the recommended frequency, method, etc. is not defined.

“The interim final regulations also provide that if a recommendation or guideline for a recommended preventive service does not specify the frequency, method, treatment, or setting for the provision of that service, the plan or issuer may use reasonable medical management techniques to determine any coverage limitations. The use of reasonable medical management techniques allows plans and issuers to adapt these recommendations and guidelines for coverage of specific items and services where cost sharing must be waived. Thus, a plan or issuer may rely on established techniques and the relevant evidence base to determine the frequency, method, treatment, or setting for which a recommended preventive service will be available without cost sharing requirements to the extent not specified in a recommendation or guideline.”

In many cases this is what plans and insurers have been doing for a wide array of health care services, typically under the heading of “medical necessity.” It is also a process that leads to ongoing controversy and which drew criticism during the health care debate. It is likely to be more controversial when applied to preventive services.

Value-Based Insurance Design (Promoting use of high value, high quality health care providers).

A third decision for plan sponsors will involve the incentives for plan participants to use certain providers for preventive services. DOL assumes that steering patients to in-network providers provides the best value. High quality may or may not accompany net work providers.

The preamble to the interim final regulations states:

“The Departments (HHS, Treasury, and DOL) recognize the important role that value-based insurance design can play in promoting the use of appropriate preventive services. These interim final regulations, for example, permit plans and issuers to implement designs that seek to foster better quality and efficiency by allowing cost-sharing for recommended preventive services delivered on an out-of-network basis while eliminating cost-sharing for recommended preventive health services delivered on an in-network basis. The Departments are developing additional guidelines regarding the utilization of value-based insurance designs by group health plans and health insurance issuers with respect to preventive benefits. The Departments are seeking comments related to the development of such guidelines for value-based insurance designs that promote consumer choice of providers or services that offer the best value and quality, while ensuring access to critical, evidence-based preventive services.”

Related Articles

Medicare fraud and waste, low administrative costs have no ROI. Why is PPACA different?

28 DecThe Patient Protection Affordable Care Act of 2010 makes a big deal of the savings to be generated from eliminating fraud, waste and abuse in Medicare. In fact. those hundreds of billions in savings over the next ten years are vital in making PPACA “affordable.” Don’t hold your breath!

Follow are excerpts from a Congressional Budget Office Report on the subject of Medicare fraud and abuse. I have highlighted a few key points in red. Take a look and see how these observations and recommendations apply to what you have heard about health care reform. In addition, you may have heard about the low administrative costs associated with Medicare as compared with those of a private insurance company. The fact is that Medicare does not review claims in any serious way and its administrative costs should be higher to better manage claim processing and review.

The grand plan to control Medicare costs contained in PPACA is just that, a grand plan. It is also interesting to note that contrary to logic and even the following report, PPACA further lowers the individual’s involvement in cost sharing and thus further reduces the concern any individual may have over fraud or excessive charges or utilization.

Oh yes, the following report was written in 1995. The problems were well-known and suggestions made to deal with them fifteen years ago…what happened? Where was Congress the last fifteen years?

The budget resolution assumes that the Congress will take actions to reduce the growth of Medicare spending by $270 billion over the 1996-2002 period. As the Congress considers alternative approaches to meeting that target, it is repeatedly confronted with claims that fraud, waste, and abuse are major factors contributing to current levels of outlays and rates of growth in Medicare. Both the general public and many Members of Congress feel that reducing or eliminating illegal or inappropriate behavior on the part of some health care providers would in turn reduce or eliminate the need for making more difficult decisions about how to limit the rate of growth in federal health spending.

Evaluating proposals to reduce fraud, waste, and abuse in Medicare involves addressing three questions. First, what kinds of spending are embodied in the terms fraud, waste, and abuse? Second, what steps could be taken to reduce fraudulent or wasteful spending and improve the integrity of the Medicare program? Finally, how would the Congressional Budget Office (CBO) estimate the savings that might stem from such efforts?

DEFINING FRAUD, WASTE, AND ABUSE

The terms waste, fraud, and abuse are often raised in discussions of federal health spending without being clearly defined or distinguished from the spending for health services that Medicare is intended to cover. One way to think of those issues is to place all of the activities for which Medicare reimburses providers on a spectrum. At one end of the spectrum are activities that are unmistakably illegal. For example, a health care provider–or, more accurately, nonprovider–who deliberately bills Medicare for services that have not been rendered to a covered beneficiary is clearly engaging in a fraudulent activity. At the other end of the spectrum are the medically necessary, competently performed, and fairly priced health care services for which Medicare is intended to pay.

Although those poles are relatively easy to identify, there is ample room between them. Moreover, no clear line separates abusive activities from fraud. One definition that has been put forth distinguishes abusive activities as those that are not illegal but that violate the intent of the program. That definition, however, offers little guidance in practice. Consider, for example, whether the following examples should be described as abuse:

A technician mistakenly takes an X-ray of a patient’s left leg, then takes a second X-ray when he discovers his error. The hospital bills Medicare for both X-rays.

A physician admits a patient to a hospital to ensure that drugs are paid for that would not otherwise be covered under Medicare.

To offset lower fees paid by Medicare, a physician begins recommending follow-up office visits for certain conditions that previously did not warrant such visits.

A managed care plan markets itself in a way that attracts relatively healthy beneficiaries, thus increasing its profits by reducing the costs of care below those envisioned in the risk-contract reimbursement formula.

Depending on one’s perspective, those activities might or might not be characterized as abusive. A definitive characterization, however, would require an understanding of both Congressional intent–that is, knowing the objective of the legislation that permitted (or prohibited) a particular activity–as well as the intent of providers or beneficiaries and the circumstances surrounding their actions. Certainly, some Medicare spending reflects abusive activities; how much is considerably less clear.

Distinguishing between spending that is wasteful and spending that is appropriate is even harder. Among the factors making that determination problematic are the uncertainties of medical science and the lack of financial incentives to limit spending.

Medicare pays for services whose ultimate success is often unknown at the individual level. For example, even the most appropriate use and careful application of diagnostic tests will often rule out a particular illness rather than confirm its presence. In addition, treating a particular illness often allows several approaches, whose costs may vary substantially. Differences in approach may reflect lack of scientific consensus or simply differences in patterns of practice among providers. Studies show that the incidence of many medical procedures varies far more among regions of the country than can be explained by differences in the characteristics of the population of patients.

Advances in medical science may reduce, but will probably never eliminate, uncertainties in diagnosis and treatment. Although negative test results or failed treatments may seem wasteful after the fact, that vantage point is not necessarily the appropriate one from which to assess the value of the services. Similarly, one may expect medical approaches to particular illnesses to become more similar over time as the most successful methods become apparent. Efforts to reduce spending by forcing that convergence to happen more quickly may stifle innovation.

Perhaps more important than the potential waste from the technical aspects of medical care is the institutional environment in which Medicare beneficiaries and health care providers meet. In markets where consumers are well-informed and pay the full costs of purchasing goods and services themselves, economists would generally not view waste as a relevant issue because people can be presumed to purchase only goods and services that are of value to them. That presumption, however, is much less valid for Medicare. Beneficiaries have had little incentive to concern themselves with costs because they may pay little or nothing at the margin for additional services. Moreover, consumers of health care are often ill-equipped to assess the risks and benefits of alternative therapeutic approaches. The financial incentives faced by health care providers in the fee-for-service sector also encourage the provision of more rather than fewer services.

Medicare spending can be reduced by changing the financial incentives given to beneficiaries and providers. For example, increasing the exposure of beneficiaries to the costs of health care at the margin could make them more cost-conscious and potentially reduce spending. As long as most Medicare beneficiaries have first-dollar coverage through the Medicaid program or through private medigap insurance, however, reducing health spending by this route is difficult. Certain types of managed care could also reduce the use of health care services–in this case by altering the incentives of providers. How much of the reduction would occur through cutting unnecessary services is less clear.

IMPROVING PROGRAM INTEGRITY

Since 1990, the General Accounting Office (GAO) has made a special effort to review and report on federal programs especially vulnerable to fraud, waste, abuse, and mismanagement. Both Medicare and Medicaid are included in that group of programs. A number of GAO reports have been released that describe specific problems or that suggest ways the Health Care Financing Administration (HCFA) might more effectively reduce the potential for fraud and abuse in its programs.

GAO has cited several factors that make it difficult to ensure the integrity of the Medicare program. One of those is the continued emphasis on unmanaged fee-for-service care, which generates incentives for providers to bill for unnecessary care. Currently, only about 9 percent of Medicare beneficiaries are enrolled in health maintenance organizations (HMOs). GAO notes, however, that managed care plans offer the potential for a different kind of abuse, which is to provide inadequate services. In the fee-for-service sector, problems include:

Weak controls for detecting questionable billing practices. All Medicare bills are screened for consistency and completeness as part of the initial processing of claims. Even very high volumes of services to individual patients or by individual providers do not necessarily trigger further review before payment. Currently, less than 5 percent of Medicare claims are reviewed.

Inadequate checks on the legitimacy of those billing the program. Medicare lacks stringent requirements for issuing billing numbers to certain providers. In some cases, phantom companies with only a post office box number have qualified to bill the Medicare program. Also, surveys of providers are too infrequent to ensure their continued compliance with Medicare’s conditions of participation.

Little chance of being prosecuted or penalized. The weak controls on billing mentioned above make it unlikely that inappropriate claims will be detected, but when they are detected recovery is uncertain. Penalties are often light, large penalties are difficult to collect, and providers often continue to bill Medicare.

HCFA believes that investment in anti-fraud and abuse activities yields a high return, paying for itself many times over by reducing spending for Medicare benefits. The Congress has established other objectives as well, however, which conflict with the objective of deterring fraud and abuse. Two of those other objectives are to ensure reasonably prompt payment to providers and to keep down the costs of processing claims. Currently, the same conflicting objectives are set for Medicare’s contractors. As a result, efforts to detect fraud and abuse may be curtailed because they would increase the costs of processing claims.It is unrealistic to think that fraud and abuse could be eliminated from Medicare, but their extent could be reduced. HCFA and other federal agencies already have a number of initiatives in place and others in the planning stages that are intended to enhance the integrity of the Medicare program. A number of initiatives are under way at HCFA:

HCFA is establishing a Medicare Transaction System for processing all Medicare claims. By 1999, that centralized system will replace the 10 different systems now used by Medicare contractors and will integrate claims from Part A and Part B. All claims for a given beneficiary or provider will be in the system, thereby simplifying claims processing and improving the agency’s ability to detect inappropriate billings.

HCFA is running a demonstration program in four states, intended to determine whether simplified and more comprehensive mailings of EOMB (explanation of Medicare benefits) statements to beneficiaries can be used as a cost-effective check on inappropriate billings. Currently, Medicare enrollees do not receive notices when benefits are paid on their behalf for services that do not require patient cost sharing (primarily home health and laboratory services).

Operation Restore Trust is a HCFA demonstration in five states targeted toward nursing facilities, home health agencies, and suppliers of durable medical equipment. The demonstration (which builds on an earlier demonstration limited to south Florida) is intended to identify and correct processes in the Medicare and Medicaid programs that make them unnecessarily vulnerable to fraud and abuse. One prominent feature of the demonstration is coordination among federal, state, and private health plans–an important factor because fraudulent practices are rarely targeted toward only one insurer.

HCFA is also examining ways to improve the provider enrollment process so that fraudulent or unqualified providers are unable to bill Medicare. Some improved procedures have already been put in place for suppliers of durable medical equipment through the National Supplier Clearinghouse, which contains nationwide information on those suppliers. Clearly, HCFA needs stronger requirements for granting Medicare participation, as well as periodic resurveys of participating providers to ensure that they remain in compliance. But HCFA is still reviewing possible corrective actions to take in those areas.

The Department of Health and Human Services (HHS) has drafted the Medicare and Medicaid Payment Integrity Act of 1995, which is intended to increase its capacity to combat fraud and abuse in Medicare and Medicaid. One provision would establish an HHS Fraud and Abuse Control Fund, which would finance further investigations of fraud and abuse from funds collected from previous settlements involving Medicare and Medicaid claims, after reimbursing the programs for their losses. A second provision would provide a dependable, long-term funding source from the Medicare trust funds to be used for initiatives to improve the integrity of the Medicare program. That funding would support specialized fraud and abuse units with multiyear contracts. Under current law, funding for activities to improve program integrity is subject to the annual appropriation process and to the statutory limits on discretionary appropriations. Because of the resulting instability in funding, HCFA has found it difficult to invest in developing strategies to control fraud and abuse, nor have Medicare contractors had much incentive to hire and train qualified auditors and investigators.

The Inspector General of the Department of Health and Human Services has been giving greater emphasis to investigating suspected instances of fraud in Medicare and Medicaid. The Inspector General estimates that each dollar spent on these investigations has generated about $7 in recoveries or fines on average for 1990 through 1994. In addition, the Attorney General has said that deterring health care fraud and abuse is the number two priority at the Department of Justice, right after deterring violent crime.

Changes in the Structure of Benefits and Administration

Many of the elements of Medicare that lead to excessive spending are embedded in the legislation establishing the program–particularly, the emphasis on unmanaged fee-for-service care and the cumbersome procedures required to revise certification requirements and payment rates. Legislation modifying those elements of the program could result in quantifiable savings.

For example, the General Accounting Office suggests that Medicare be allowed to price services and procedures more competitively. According to GAO, that recommendation could encompass streamlining processes required to revise excessive payment rates, allowing competitive bidding for services, and negotiating prices. CBO has prepared estimates for many specific proposals of this type, such as limiting payments to physicians in hospitals whose costs far exceed the national median, bundling payment for post-acute care services into payments to hospitals, requiring competitive bidding for certain durable medical equipment and diagnostic tests, establishing payment limits for outpatient department services not covered under current cost limits, and revising cost limits for home health services and skilled nursing facilities.

Another GAO recommendation is to require health care providers to demonstrate their suitability as a Medicare vendor before giving them unrestricted billing rights. Under that rubric GAO mentions establishing preferred provider networks, developing more rigorous criteria for authorization to bill the program, and using private entities to provide accreditation or certification. CBO has already prepared an estimate for a proposal to establish a preferred provider option for both Parts A and B of Medicare.

Those examples are but a few of the ways in which this Committee might achieve real savings by improving the management of the Medicare program. The Congressional Budget Office will continue to work closely with your staff to provide estimates of those or similar provisions that the Committee may wish to consider.

CONCLUSION

Fraud and abuse clearly exist in Medicare, just as in all other public and private health plans, but estimates of potential losses from fraud and abuse are inherently speculative. If HCFA and private insurers had good information about the extent of the problem, they would know how to eliminate it. Moreover, fraud and abuse are not easily trimmed from the edges of the program but are marbled throughout the system. In Medicare, as elsewhere in the federal budget, there is no line item labeled “fraud, waste, and abuse.”

The General Accounting Office and others have made many suggestions for reducing what they see as wasteful spending by pricing Medicare services and procedures more competitively and choosing health care providers more selectively. Some of those proposals could significantly slow the growth of spending in Medicare. In contrast, several considerations limit the savings to be expected from new payment safeguard initiatives. No savings should be expected without an assurance that the funding intended for specific initiatives to promote program integrity will be used for those purposes and that funding will be maintained in future years. Even with such assurances, and with some evidence of the savings achieved by similar initiatives in the past, the amount of savings to be expected is uncertain because diminishing returns are sure to set in as additional resources are devoted to those activities. Finally, CBO must evaluate any legislative proposal using the scorekeeping rules established by law and longstanding practice. If the Congress finds that spending more on efforts to further program integrity would represent good Medicare policy, however, it can and should ensure the necessary funding.

Related Articles

- (eon.businesswire.com)

- (seniorhousingnews.com)

End of life plannning is not death panels – Sarah Palin please think before your speak

26 DecThe New York Times is reporting that the Obama administration has implemented end of life planning within Medicare through new Medicare regulations. During the health care reform debate this information was targeted as “death panels.”

However, I would characterize the process as common sense.

Patients do need to know options for themselves and their families. In fact, a prudent person will plan way ahead with the proper legal documents expressing their wishes well in advance of an emotional period during a serious and perhaps terminal illness.

Nevertheless, you can expect a significant backlash and the cry of death panels once again. Understand the facts before you draw conclusions. Some individuals will see this as government involvement in telling people how to end their life, but the fact is that doctors routinely advise patients about this topic. What is changing is that Medicare will reimburse for the time spent on such counseling. One must have a very cynical view of other human beings to believe that this process will result in doctors encouraging people to die sooner rather than later.

Related Articles

- Upcoming Obama Regulation Will Likely Revive “Death Panels” Rhetoric (themoderatevoice.com)

- Death Panels issue raised by Medicare Regulation-Your Funeral Guy (yourfuneralguy.wordpress.com)

- White House To Encourage End-Of-Life Planning; Expect RWNJ’s To Talk “Death Panels” Again (alan.com)

Merry Christmas or as they would also say in my local Lowes, Feliz Navidad

24 Dec

I hear Happy Holidays so often I am almost reluctant to wish someone a Merry Christmas, but Merry Christmas nevertheless.

I hear Happy Holidays so often I am almost reluctant to wish someone a Merry Christmas, but Merry Christmas nevertheless.

I just put my electric trains under the tree, a set of 1920 Lionel and I guess it is fair to say, they don’t make them like that anymore. They were my father’s when he was a boy and all I have left of the original set is the engine, but it runs and I have managed to replace the missing cars and track. My children have long ago out grown playing with trains (as if that is ever really possible), but a new generation of grandchildren is starting to enjoy them albeit for only a few minutes at a time.

The way things are going these days, the trains may be the most valuable thing I have left to give them, the rest will be somewhere in the US treasury. Blast, I wanted to avoid politics this one day.

Ho, Ho, Ho enjoy the day for tomorrow we spend again.

Merry Christmas

Do politicians have a right to criticize corporate bonuses?

22 DecBonus seems to be a dirty word these days, you know as in Wall Street bonuses or bank bonuses. Bonuses are paid because of the performance of an organization and an individual’s role in that performance. While one can argue with accuracy that some bonuses are not well deserved, the fact is that a bonus is designed to elicit better performance in achieving certain goals (the fact one is paid to do a job notwithstanding). As a retired compensation and benefits executive, I know firsthand how tenuous the relationship between individual performance and a goal can be. In fact, one of the biggest problems in creating incentive plans is the line of sight between the individual job and the high-level goal. Politicians have no such problem however.

Incentive plans and bonuses can motivate in the wrong way, they can lead to manipulation of the results, sweet heart deal targets and in some cases outright cheating. In other words, if you incentivize someone to do something, he or she usually will do it and in some cases at any cost. You know, like providing incentives for people to buy homes they cannot afford.

Because of the financial crisis politicians were quick to jump on the anti bonus bandwagon. The bonuses were not earned, they took a bonus and a taxpayer bailout, bonuses were outrageously large, and bonuses were paid for results while Rome burned. There is some validity to all this criticism, but politicians are hardly the ones to level it.

How is incenting someone through bonuses any different from taking PAC money or loading legislation with unaffordable earmarks favoring local voters or voting for massive legislation without any means of paying for it? In both cases, someone is seeking a reward for their actions and their actions may well be irresponsible and harmful to the larger good.

How is incenting someone through bonuses any different from taking PAC money or loading legislation with unaffordable earmarks favoring local voters or voting for massive legislation without any means of paying for it? In both cases, someone is seeking a reward for their actions and their actions may well be irresponsible and harmful to the larger good.

Politicians want to be re-elected; executives want more money in part to contribute to friendly politicians running for reelection who in turn want to criticize high bonuses to appear favorable in the eyes of their constituents.

Good grief, we all could use five cents worth of psychiatric care.

HHS issues regulations to control excessive premium increases sought by health insurance companies – still barking up the wrong tree

21 DecUnder proposed regulations issued December 21, 2010, health insurers in the individual and small group market must justify premium increases of 10% or more. States or the Department of Health and Human Services will have the authority to review the proposed increases and determine if they are reasonable. Given that many self-insured employer plans are experiencing cost increases of ten percent or more, it is curious why such increases are considered unreasonable in the insured arena. In addition, with the elimination of underwriting rules so that individuals cannot be denied coverage and children must be covered to age 26, it seems strange that market forces and the competition so touted by PPACA proponents are not self monitoring. After all, if I can enroll in any plan and can’t be turned down wouldn’t I enroll in the least costly plan thereby providing an incentive for an insurer to seek my business? We can only wonder how “unreasonable” will be defined from state to state. A 20% increase may indeed be excessive, but that does not mean it is not justified for a given book of business. Is this anything like the prudent man rule?

For the record, we have just placed the politicians smack in the middle of setting your health insurance premiums, never mind what may be justified or needed to sustain your coverage. Never let it be said that we let facts stand in the way of “reform.”

From HHS

Making the Market More Transparent

The amount of information about rate increases currently available to consumers significantly varies among States. Some States review proposed increases in health insurance rates and disapprove them if they are excessive. Other States lack the legal authority or resources to effectively review rates.

The proposed regulation will ensure that large rate increases in all States will be thoroughly reviewed.

The proposed regulation will:

- In 2011, require that all insurers seeking rate increases of 10 percent or more in the individual and small group market publicly disclose the proposed increases and the justification for them. Such increases are not presumed unreasonable, but will be analyzed to determine whether they are unreasonable.

- After 2011, a State-specific threshold will be set for disclosure of rate increases, using data and trends that better reflect cost trends particular to that State.

- Under the proposed regulation, States with effective rate review systems would conduct the reviews. If a State lacks the resources or authority to do thorough actuarial reviews, HHS would conduct them. Meanwhile, HHS will continue to make resources available to States to strengthen their rate review processes.

Whether performed by States or HHS, information about the outcome of all reviews for increases above 10 percent, along with justification provided by insurance companies for those increases determined to be unreasonable, will be posted on the HHS website. The insurance plan will also have to make its justification for a rate increase available on its own website.

This regulation builds on the Affordable Care Act’s efforts to strengthen State rate review efforts. Importantly, we know rate review works. For example, Connecticut regulators recently rejected a proposed 20 percent rate increase after their review found that such an increase would be excessive. Unfortunately, some States lack the authority or resources to review proposed health insurance rates.

Related Articles

- Health Insurance Rate Hikes: Unreasonable if Excessive, Excessive if Unreasonable (reason.com)

- Insurer rate hikes to face fresh federal scrutiny (seattletimes.nwsource.com)

- HHS reg: Magic number is 10 percent (politico.com)

- The interventionist dynamic, health care installment #2,074 (marginalrevolution.com)

How much risk are the politicians taking with our future?

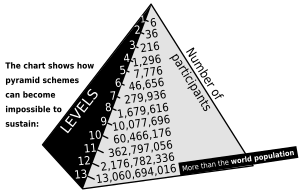

21 Dec“With the private sector recovering, albeit slowly, and public finances worsening, the time to restore our public finances to health is now. And if doing so delays the economy’s return to full and robust growth, then let the recovery come more slowly — and let it be built on sound financing and not on a new pyramid of debt.”

Debt Pyramid Scheme Now the Norm in America – Roger Lowenstein Bloomberg.com December 20,2010

Something for everyone today and the next generation be damned (until they can vote). On one hand deficit commissions want to raise Social Security retirement age to 67 and today we put the program deeper in the hole. Thinking short-term tends to make long-term problems that much more difficult to deal with – except the politicians who didn’t get re-elected can just walk away. We delude ourselves with short-term fixes that often do not work, prolong the recovery and now add to the national debt like never before.

“First and foremost, the legislation I’m about to sign is a substantial victory for middle-class families across the country. They’re the ones hit hardest by the recession we’ve endured. They’re the ones who need relief right now. And that’s what is at the heart of this bill.

This bipartisan effort was prompted by the fact that tax rates for every American were poised to automatically increase on January 1st. If that had come to pass, the average middle-class family would have had to pay an extra $3,000 in taxes next year. That wouldn’t have just been a blow to them — it would have been a blow to our economy just as we’re climbing out of a devastating recession.

I refused to let that happen. And because we acted, it’s not going to. In fact, not only will middle-class Americans avoid a tax increase, but tens of millions of Americans will start the New Year off right by opening their first paycheck to see that it’s actually larger than the one they get right now. Over the course of 2011, 155 million workers will receive tax relief from the new payroll tax cut included in this bill -– about $1,000 for the average family.

This is real money that’s going to make a real difference in people’s lives. And I would not have signed this bill if it didn’t include other extensions of relief that were also set to expire -– relief that’s going to help families cover the bills, parents raise their children, students pay for college, and business owners to take the reins of the recovery and propel this economy forward.

As soon as I sign this legislation, 2 million Americans looking for work who lost their jobs through no fault of their own can know with certainty that they won’t lose their emergency unemployment insurance at the end of this month. Over the past few weeks, 600,000 Americans have been cut off from that lifeline. But with my signature, states can move quickly to reinstate their benefits –- and we expect that in almost all states, they’ll get them in time for Christmas.

Eight million college students who otherwise would have faced a tuition hike as soon as next semester will instead continue to have access to a $2,500 tax credit to afford their studies.

Twelve million families with 24 million children will benefit from extensions of the Earned Income Tax Credit and the Child Tax Credit. And when combined with the payroll tax cut, 2 million American families who otherwise would have lived in poverty next year will instead be lifted out of it. (Applause.)

And millions of entrepreneurs who have been waiting to invest in their businesses will receive new tax incentives to help them expand, buy new equipment, or make upgrades — freeing up other money to hire new workers.

Putting more money in the pockets of families most likely to spend it, helping businesses invest and grow — that’s how we’re going to spark demand, spur hiring, and strengthen our economy in the New Year.”

Barack Obama

Why does a physician office visit cost double what general inflation dictates?

20 DecIn 1961 when I started working in employee benefits as a health benefit claim processor, an office visit was $5.00. Based on the change in CPI since then, an office visit should cost about $36.59.

Today a basic follow-up office visit will be $60.00 to $70.00, an initial office visit will be more and a specialists office visit $150.00 and sometimes way more.

So what happened? Why are we paying so much more than inflation would seem to indicate? The cause of health care inflation is often attributed to new technology, an aging population and the cost of prescription drugs, so what’s the deal with an office visit?

Remember, there are two basic factors in determining overall health care costs. The cost per service and the number of services rendered. Costs (and premiums) increase if either factor increases and when both increase there is a multiplying impact. We know an office visit costs about twice what the CPI indicates it should. We know more and more costly services are being provided – ”let’s get an MRI to be sure” – considering both, we have solved the mystery of health care costs…and we didn’t even mention an insurance company.

However, we still don’t know why an office visit charge is double what it should be. Wouldn’t it be ironic if the high cost of an office visit is attributable to the cost of health insurance for the office staff?

Clearly, the cost of health care is more complicated than this simple scenario, but keep in mind utilization is a major factor and you and your doctor can have a significant impact. More health care is not necessarily better health care.

Related Articles

Interest in Behavior-Changing Financial Incentives Declines in 2010

18 DecThe overall percentage of people who think getting a financial incentive would be extremely or very useful for choosing a more effective treatment decreased from 61 percent in 2009 to 55 percent in 2010, according to new report released today by the nonpartisan Employee Benefit Research Institute (EBRI). Similarly, the percentage of people who had an interest in using high-quality provider networks that offer lower cost sharing dropped from 45 percent in 2009 to 42 percent in 2010.

Despite the overall drop, young people, minorities, and low-wage workers are still more likely to find financial incentives extremely or very useful, EBRI found. There was no significant difference between women and men and no difference found in education level.

The data is based on the EBRI/MGA 2010 Health Confidence Survey to examine whether health care consumers would be interested in, or might find useful, financial incentives that are aimed at changing an individual’s health behavior. The findings are published in the December EBRI Notes, “Who Might Respond to Financial Incentives That Use Lower Cost Sharing to Change Behavior? Findings from the 2010 Health Confidence Survey.” The full report is online at EBRI’s website at www.ebri.org

The data is based on the EBRI/MGA 2010 Health Confidence Survey to examine whether health care consumers would be interested in, or might find useful, financial incentives that are aimed at changing an individual’s health behavior. The findings are published in the December EBRI Notes, “Who Might Respond to Financial Incentives That Use Lower Cost Sharing to Change Behavior? Findings from the 2010 Health Confidence Survey.” The full report is online at EBRI’s website at www.ebri.org

“There is a distinct difference between the attitudes of younger and older consumers as it relates to the impact of financial incentives to steer behavior,” said Paul Fronstin, director of EBRI’s Health Research and Education Program and author of the report. “And this study gives us the opportunity to track the trends of how each demographic is feeling about the usefulness of certain incentives offered to them.”

Among the findings in the report:

· Demographics : Younger individuals were more likely than older ones to report that incentives to choose the most effective treatment would be extremely or very useful. Sixty-two percent of persons under age 45 reported that they would find incentives useful, compared with 52 percent of 45−64 year olds and 41 percent of individuals age 65 and older.

· Health Status : Among those who reported that their health status had gotten worse during the past five years, about 18 percent reported that they did not think that a lower cost-sharing incentive to choose more effective treatments would be useful. In contrast, about 9 percent of individuals whose health status had gotten better in the last five years did not think that a lower cost-sharing incentive to choose more effective treatments would be useful.

· Health Costs : Individuals who reported that they had not experienced an increase in either premiums or cost sharing were more likely than those who had to report that lower cost sharing would not be a useful incentive to choose a more effective treatment. Similarly, those experiencing a cost increase were more likely than those who had not to report that they would be interested in lower cost sharing as it relates to using a limited network of high-quality providers.

EBRI is a private, nonprofit research institute based in Washington, DC, that focuses on health, savings, retirement, and economic security issues.

Related Articles

- (money.usnews.com)

- Will Health Care After Retirement Really Cost More Than $200,000? (walletpop.com)

HHS issues new strategic framework on multiple chronic conditions, but is it really coordinated?

17 DecFollowing is the text of a recent press release from HHS. The goal of this effort is worthy and necessary. Better coordinating health care for those with chronic conditions or any patient for that matter leads not only to better health care, but also to fewer adverse interactions and wasted dollars for duplicative care and tests.

However, take a close look at the list below. Does giving money to several different agencies and groups all looking at different aspects of the same problem sound like a coordinated strategy? Look at each of these programs; do some efforts sound duplicative? Other projects are doing research on what appears to have an obvious answer or at least one that has been previously considered by someone. Why are we spending $40 million to learn how to measure the value of coordinated care while concurrently spending $18 to learn how to optimize care?

In fact, I know only what I read below about this effort. However, I do know that a strategic, coordinated effort would be more focused, and would approach each of the related issues is a more progressive manner building on the findings of each element from the bottom up. In this final analysis, is this the best way to address a valid problem by throwing tens of millions of dollars in different directions in a shotgun approach?

Here is another point and reflective of the current mindset of the role of government:

“The Affordable Care Act, with its emphasis on prevention, provides HHS with exciting new opportunities to keep chronic conditions from occurring in the first place and to improve the quality of life for patients who have them.”

Is it the job of HHS to keep chronic conditions from occurring or is that the job of the individual and his or her doctor? It is these types of programs, while working toward better health care, that cause many Americans to question the intervention of the federal government into private matters. During the health care debate, proponents, including the President, repeatedly said that no one should come between you and your doctor (but they were referring to insurance companies).

HHS issues new strategic framework on multiple chronic conditions

The U.S. Department of Health and Human Services today issued its new Strategic Framework on Multiple Chronic Conditions ― an innovative private-public sector collaboration to coordinate responses to a growing challenge.

More than a quarter of all Americans ― and two out of three older Americans ― have multiple chronic conditions, and treatment for these individuals accounts for 66 percent of the country’s health care budget. These numbers are expected to rise as the number of older Americans increases.

The health care system is largely designed to treat one disease or condition at a time, but many Americans have more than one ― and often several ― chronic conditions. For example, just 9.3 percent of adults with diabetes have only diabetes, according to the Medical Expenditure Panel Survey from the Agency for Healthcare Research and Quality (AHRQ). And as the number of chronic conditions one has increases, so, too, do the risks of complications, including adverse drug events, unnecessary hospitalizations and confusion caused by conflicting medical advice.

The new strategic framework ― coordinated by HHS and involving input from agencies within the department and multiple private sector stakeholders ― expects to reduce the risks of complications and improve the overall health status of individuals with multiple chronic conditions by fostering change within the system; providing more information and better tools to help health professionals ― as well as patients ― learn how to better coordinate and manage care; and by facilitating research to improve oversight and care.

“Individuals with multiple chronic conditions deserve a system that works for them,” said Assistant Secretary for Health Howard K. Koh, MD, MPH. “This new framework provides an important roadmap to help us improve the health status of every American with chronic health conditions.”

The management of multiple chronic conditions has major cost implications for both the country and individuals. Increased spending on chronic diseases is a key factor driving the overall growth in spending in the Medicare program. And individuals with multiple chronic conditions also face increased out-of-pocket costs for their care, including higher costs for prescriptions and support services.

“Given the number of Medicare and Medicaid beneficiaries with multiple chronic conditions, focusing on the integration and coordination of care for this population is critical to achieve better care and health for beneficiaries, and lower costs through greater efficiency and quality,” said Centers for Medicare and Medicaid Administrator Donald Berwick, MD.

The Affordable Care Act, with its emphasis on prevention, provides HHS with exciting new opportunities to keep chronic conditions from occurring in the first place and to improve the quality of life for patients who have them.

“We need to learn rapidly how to provide high quality, safe care to individuals with multiple chronic conditions. AHRQ’s investments assess alternative strategies for prevention and management of chronic illness, including behavioral conditions, in persons with varying combinations of chronic illnesses,” said AHRQ Director Carolyn M. Clancy, MD.

HHS has taken action in recent months to improve the health of individuals with multiple chronic conditions. Some examples include:

- Administration on Aging (AoA)/ Centers for Medicare and Medicaid Administrator (CMS)

AoA and CMS jointly announced $67 million in grants to support outreach activities that encourage prevention and wellness, options counseling and assistance programs, and care transition programs to improve health outcomes in older Americans.

- Agency for Healthcare Research and Quality (AHRQ)

AHRQ awarded more than $18 million dollars (American Recovery and Reinvestment Act) in two categories of grant awards to understand how to optimize care of patients with multiple chronic conditions.

- Assistant Secretary for Planning and Evaluation (ASPE)

As part of an existing $40 million ASPE contract, the National Quality Forum is undertaking a project to develop and endorse a performance measurement framework for patients with multiple chronic conditions.

- Centers for Disease Control and Prevention (CDC)

CDC is supporting a new project ― Living Well with Chronic Disease: Public Health Action to Reduce Disability and Improve Functioning and Quality of Life ― in which the Institute of Medicine will convene a committee of independent experts to examine the burden of multiple chronic conditions and the implications for population-based public health action.

- Centers for Medicare and Medicaid Services (CMS)

CMS has provided recent guidance to State Medicaid directors on a new optional benefit available Jan. 1, 2011, through the Affordable Care Act, to provide health homes for enrollees with at least two chronic conditions, or for those with one chronic condition who are at risk for another.

- Food and Drug Administration/ Assistant Secretary for Planning and Evaluation (FDA/ASPE)

FDA and ASPE launched a study to examine the extent to which individuals with multiple chronic conditions are being included or excluded from clinical trials for new therapeutic products.

- Indian Health Service (IHS)

IHS has expanded its Improving Patient Care Program to nearly 100 sites across the tribal and urban Indian health system to assist in improving the quality of health care for patients with MCC.

NIH has committed $42.8 million for a study to determine whether efforts to attain a lower blood pressure range in an older adult population will reduce other chronic conditions.

- Substance Abuse and Mental Health Services Administration (SAMHSA)

SAMHSA awarded $34 million in new funding to support the Primary and Behavioral Health Care Integration Program, which seeks to promote the integration of care with people with co-occurring conditions.

For more information about the new HHS Strategy on Multiple Chronic Conditions, go to: http://www.hhs.gov/ash/initiatives/mcc/

Related Articles

Rioting and violence in the streets of England, France, Greece and Italy, is the US next?

16 DecHave they gone mad? No, they have not gone mad, but they are mad and generally about similar things. Americans would do well to take notice and better understand the implications for an entitlement crisis. The students, the union workers and others in the streets of these countries are all angry about one thing, they are getting less or paying more for the goodies the “government” provides, the entitlements, the subsidies for this or that or the overly generous pension promises. The rioters seem unable to make a connection between the benefits they seek and the long-term cost to provide them. All these countries spend more than they should, built up more debt than they can handle and make promises that are unrealistic to keep, especially when an economy goes south.

The United States does all of these things on a grander scale, are we that different? The question remains to be seen because we have so far been effective in pushing the reckoning forward one year at a time. However, something has to give and as long as politicians are not held accountable, our hole gets deeper each year. Sure, entitlements are nice, we all find a way to enjoy one or more, but that does not make them affordable, right, or even good policy.

Every Congress that adds an entitlement or expands an existing one commits future generations to the cost burden, eventually pitting one generation against the next, creates expectations that must be fulfilled (or suffer the consequences) and relieves Americans of more and more personal responsibility. A population that is more and more dependent on its government and its politicians cannot survive as a thriving society for long, such dependence is a road to mediocrity.

Related Articles

- Why a Royal Rolls-Royce is a Symbol of Times Ahead (curiouscapitalist.blogs.time.com)

- Tens of thousands protest in Greece as Europe braces for austerity backlash (calgaryherald.com)

- The Curse of Entitlement (socyberty.com)

- How to Talk America Down From Impending Fiscal Suicide (fool.com)

What to do with your 2% pay increase in 2011. Stimulate your retirement with the Obama/ Republican tax deal

15 DecIf all goes according to plan, come 2011 the payroll tax for Social Security will drop by 2%, but just for 2011. Setting aside the questionable wisdom of further underfunding a program already facing financial trouble, it is still 2% more in your pocket (up to the Social Security taxable wage).

So what do you do with that money? The policy makers hope you will spend it to help “stimulate” the economy. The economists fear you will pay off debts rather than spend it and I encourage you to take the 2% and up your 401(k) or IRA contribution by 3% for 2011 (with any luck you will forget to lower it in 2012).

Why 3% more in savings, because it is pre-tax money if you put it in your retirement plan and that allows you to save more on a pre-tax basis and keep about the same amount in take home pay. Another strategy is to place the 2% (after-tax money) into a Roth IRA or into the Roth portion of your 401(k) plan if you are so fortunate. The Roth contribution means the earnings will be tax-free when you need them in retirement and with the long-term questionable status of Social Security and income taxes, tax-free money may be very attractive down the road when you most need it.

A two percent raise and you did not even have to get a good performance evaluation. This windfall puts the oil companies to shame.

Do not let it go to waste.

Related Articles

- Roth 401(k) and Roth 403(b) Plans (turbotax.intuit.com)

- Boost Your Retirement Savings (turbotax.intuit.com)

Investing in your 401(k) plan, investing in yourself, the reality of investment returns and what you need to do about it

14 DecConventional wisdom says saving for retirement must include a good portion of equity investments, especially for individuals many years from retirement and that may be true. However, as an example, here is a look at the actual performance of a group of funds making up the options in a large 401(k) plan. Note especially the performance over the last ten years and the relative small variance among the funds. Granted another ten-year period may tell a different story. During a period in the 1980s the Stable Value fund was returning up to 16% a year and during another period equities were flying high. Nevertheless, the 401(k) investor must balance a good return with a measure predictability and stability especially within ten years of retirement. As we have seen in the last three years, the unthinkable can happen and those who are not well diversified and those who do not make investment adjustments according to their retirement plans can suffer greatly.

If you are depending on 401(k) or IRA savings to fund your retirement, you should (1) determine the amount of money you will need in a lump sum (25 times the annual amount you need to live on is a good rule of thumb), (2) determine the maximum amount you can save (a minimum of 10% of each years income is essential), and (3), based on the estimated amount you can save and your goal determine what return you need on your investments to meet that goal. Then invest as conservatively as possible for the best chance to meet your objective over time. That may help you better sleep at night. The most important thing is to know your real goal and establish a realistic plan to achieve that goal.

To obtain a different perspective on how much money you will need, obtain an estimate of how much you will required to purchase an immediate life annuity for the amount of income you want in retirement. You can do that by visiting Here is an example, if you are 65 years old and want a guaranteed monthly payment of $5,000 for your life, you will need approximately $827,711 to purchase such an annuity (varies by state). You will need even more to provide a survivor benefit for a spouse.

Don’t make the mistake of thinking you can live on 20 or 30% less in retirement than you do today. While some expenses may go down, others will increase, especially health care expenses. Property taxes or rent will continue to increase. You still have to eat and those 5:00 PM early bird specials get old after a few years. In addition, unless you plan to sit at home and watch Everybody Loves Raymond reruns all day, you will want money to do stuff. This may be counter to many experts advice, but take it from someone who is retired, you want to shoot for 100% replacement of your pre-retirement income and you must plan for the ongoing living expenses for a surviving spouse and you must plan for the impact of inflation (yes, there will be inflation again someday). If all this is overwhelming, get help, it is that important.

Don’t make the mistake of thinking you can live on 20 or 30% less in retirement than you do today. While some expenses may go down, others will increase, especially health care expenses. Property taxes or rent will continue to increase. You still have to eat and those 5:00 PM early bird specials get old after a few years. In addition, unless you plan to sit at home and watch Everybody Loves Raymond reruns all day, you will want money to do stuff. This may be counter to many experts advice, but take it from someone who is retired, you want to shoot for 100% replacement of your pre-retirement income and you must plan for the ongoing living expenses for a surviving spouse and you must plan for the impact of inflation (yes, there will be inflation again someday). If all this is overwhelming, get help, it is that important.

Don’t look to the past for examples, the future is different like never before, the world is changing and it’s time to get your head out of your gluteus maximus and get a plan, take action and execute it.

Average Annual Returns (as of 11-30-2010) 1 Year 3 Years 5 Years 10 Years Mixed Portfolios Conservative Portfolio 7.90% 1.30% 4.10% 4.50% Moderate Portfolio 9.10% -0.70% 3.70% 4.30% Aggressive Portfolio 11.50% -2.30% 3.20% 4.10% Stable Value Stable Value 3.90% 3.90% 4.20% 4.50% Bond Diversified Bond 6.20% 5.30% 5.50% 5.70% Large-Cap Equity Large Company Stock Index 9.80% -5.80% 4.80% 4.50% Mid-Cap Equity Mid-Cap Index 24.90% -1.60% 3.20% 1.90% International Equity Institutional Developed Markets Index 1.10% -9.10% -1.70% 4.30% Small-Cap Equity Small-Cap Index 28.00% 0.90% 3.90% 7.40% Company Stock 2.30% -10.20% 3.10% 7.90% Target Retirement Target Retirement Income 7.40% 3.00% 4.90% N/A Target Retirement 2010 8.70% 0.60% N/A N/A Target Retirement 2015 9.30% -0.30% 3.80% N/A Target Retirement 2020 9.60% -1.10% N/A N/A Target Retirement 2025 10.00% -2.10% 3.10% N/A Target Retirement 2030 10.30% -3.00% N/A N/A Target Retirement 2035 10.50% -3.50% 2.50% N/A Target Retirement 2040 10.60% -3.40% N/A N/A Target Retirement 2045 10.60% -3.50% 2.70% N/A Target Retirement 2050 10.60% -3.50% N/A N/A

Recent Comments