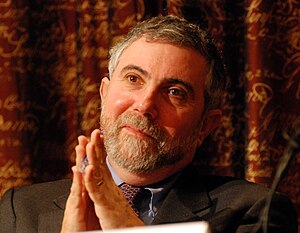

The Ryan plan to reform Medicare has been widely criticized mainly because it employs a voucher system. Among those critics is Paul Krugman. However, there is a different point of view that deserves serious consideration. Are the exchanges coming as part of the Affordable Care Act much different from a voucher program? Will the government simply keep increasing its subsidy to millions of Americans at a rate unconstrained by a reasonable percentage? How do you manage a vast government program such as health care without a managed budget? Consider this view on the matter. Critics of the Ryan plan have a lot to say but offer little concrete as an alternative. Even the many provisions contained in the Affordable Care Act while headed toward the right goal are untried, untested and difficult to measure with results unknown for many years. In effect they are a very soft approach to solving a very hard problem.

Professor Laurence Kotlikoff writes for Bloomberg.com

Critics Respond

These questions are forcing Ryan’s critics to respond. Paul Krugman’s recent New York Times column, “Medicare Is Not Vouchercare,” is a case in point. Krugman manages to drop the V-word in his title and nine times in his column. As for his other words, they are, well,

First, Krugman suggests that Medicare directly pays all health-care providers. Not so. More than one fifth of Medicare participants are enrolled in Medicare Part C, in which the government makes payments to providers through private insurance companies. That’s the same system that Ryan is proposing, albeit for all participants.

Second, Krugman says vouchercare “would pay a fixed amount toward private health insurance — higher for the poor, lower for the rich, but not varying at all with the actual levels of premiums.”

Again, not so. All the plans — Ryan’s, Rivlin-Ryan, my own, the president’s health-care exchanges and Medicare Part C – - explicitly or implicitly adjust payments according to the patient’s risk profile, providing larger amounts for those with higher expected health-care costs.

Next Krugman claims that “If you couldn’t afford a policy adequate for your needs, even with the voucher, that would be your problem.” Nope. The voucher plans will require insurers to offer a basic policy whose coverage is set by a medical panel. No one can be turned down by participating insurers.

I urge you to read the full article here.

Related articles

- Competing Ideas for Saving Medicare (nytimes.com)

- Paul Krugman Simply Explains Why Ryan Care Ends Medicare As We Know It (alan.com)

- Vouchercare – When Truth is Demagoguery (jonathanturley.org)

Tags: Laurence Kotlikoff, Paul Krugman

Projected Medicare Funding needs are fully manageable;see below.

Medicare-the True Problem, the Ryan Plan and Better Solutions

Introduction

The Medicare program includes Part A Hospital Insurance (HI) which is paid by payroll taxes, Part B or Supplementary Medical Insurance- for physician and outpatient services- which is paid by premiums taken out of Social Security retirement payments and general tax revenues as needed, and Part D prescription drug coverage paid mostly by premiums. Medicare has worked well, providing substantial health care insurance for millions of seniors at a very low over head of 3% compared to an average of 15% for private insurance.

Costs for Medicare as a percentage of the Gross Domestic product (GDP) increase through 2035 because:(1) the number of beneficiaries rises rapidly as the baby-boom generation retires and (2) the lower birth rates that have persisted since the baby boom cause slower growth of both the labor force and (GDP). Under current law, projected Medicare costs increase from 3.6 % of GDP in 2010 to 5.6 percent of GDP by 2035, leveling off at 6.2 % through 2085.

The Real Medicare Problems

Despite much scary talk about insolvency and unsustainability, the real problems facing Medicare funding are first a projected shortfall in the HI program funding beginning in 2024 when that trust fund is depleted and the Program then relies only on annual payroll tax revenue. Over subsequent years that shortfall averages about 1% of taxable payroll, or about 33% more than the 3% payroll tax devoted to Part A. For perspective that is about $140 billion a year. Second, according to the official Medicare Trustee Report, Parts B and D are both projected to remain adequately financed into the indefinite future because current law automatically provides financing from general tax revenues as needed each year to meet the next year’s expected costs. However, to do so requires increasing the amount taken from general revenues from 1.5% of GDP in 2010 to 2.5% of GDP in 2030. This 1% increase amounts to about $210 billion a year. To many, affordable and secure health care for the elderly through Medicare is a planned for national priority that should just be paid; to others it is considered a strain on the deficit. In any case these amounts are not insurmountable to address sensibly, without resorting to draconian measures as in the Ryan Plan discussed below.

The Ryan Plan

Under the Ryan plan, starting in 2022, the government would issue new Medicare beneficiaries a voucher payment that they would use to purchase private insurance. These payments would increase in line with the consumer price index but not with faster-rising health costs. The slower increase in payments would generate large savings (and less risk) for the federal government.

The Congressional Budget Office (CBO) has analyzed the Ryan Plan. Their analysis confirms that federal expenditures would be reduced, by a lot. The Table below shows that government payments in 2022 for an average age senior would be reduced more than 25 percent. But on whether the shift to private sector insurance embodied in the Ryan plan would reduce total health care costs, the CBO conclusion is shocking: the plan would not only fail to decrease total health care costs per beneficiary, it would increase them – by an astonishingly large amount that grows over time. By 2022, total health care costs for a typical beneficiary would be 40 percent higher under the Ryan plan than under existing Medicare, as shown in the bottom row of the Table below. This is because private plans have profit, higher administrative costs than the Medicare program, and less negotiating leverage with health care providers in controlling their prices. Such an outcome when you are trying to address a cost issue makes little sense.

Equally important is the impact on senior’s out of pocket costs to pay the difference between the private insurance cost and the voucher amount. As shown in the Table, a 65 year old senior’s costs would increase $6400 (the difference between the Ryan and Medicare numbers) in 2022 under the Ryan Plan. Further, since medical costs and insurance rates go up for older seniors, an average age senior (between 65 and end of life) would incur an increased out of pocket cost of about $14,000. This would essentially require using ones entire Social Security retirement check for health insurance. Most seniors could not afford this; they would have to forego insurance-and care-or have their children pay for it.

. Costs under Traditional Medicare and the Ryan Plan-2022.

65 year old 65 year old Average Age Senior Average Age Senior

Medicare Ryan Medicare Ryan

Government Cost $8600 8000 15,000 11,000

Senior Cost 6100 12,500 10,700 24,720

Total Cost 14,700 20,500 25,700 35,720

Better Solutions

So, in terms of both cost control and providing affordable healthcare to seniors the Ryan Plan is no solution at all. It makes much more sense to fix the current Medicare program rather than destroy it (in the name of saving it). The projected HI program shortfall could be fixed by increasing the HI payroll tax or by shifting some of the Social Security (SS) payroll tax to cover Medicare HI instead of SS. But the smartest thing might be to just wait, let the economy recover and along with it payrolls and HI revenues. Then see what shortfall remains and address it.

The general revenue increase needed for Part B could be reduced by additional reductions in health care delivery costs, beyond those begun in the Affordable Health Care Act. We spend about 75% more on health care per person than other developed countries, with no clearly superior health benefits from that. About 30 % of that 75% difference is from more private insurance use and resultant overheads in the U.S., still leaving a substantial percentage reduction achievable from health care delivery costs themselves. A modest cut of 10% in those costs by 2022 would reduce the general revenues needed for Part B by about half, to about $120 billion a year, or only 4% of expected general tax revenues (excluding payroll taxes). This is a manageable amount.

Conclusions

The Ryan Plan is simply not cost-effective. It not only raises overall costs and destroys the Medicare Program; it puts health care out of reach for most seniors. Funding shortfalls in the Medicare Program are resolvable in much more efficient ways to sustain this proven Program.